ST. JOHNS COUNTY, Fla. — Voters decided Tuesday to raise their taxes for schools in St. Johns County and for land conservation in Clay County.

Both counties are overwhelmingly Republican but have shown support in the past for referendums that dedicated tax increases for specific spending purposes.

St. Johns County became the latest Northeast Florida county to turn to local taxes to supplement state funding for public education. Here's how voters decided the question this time.

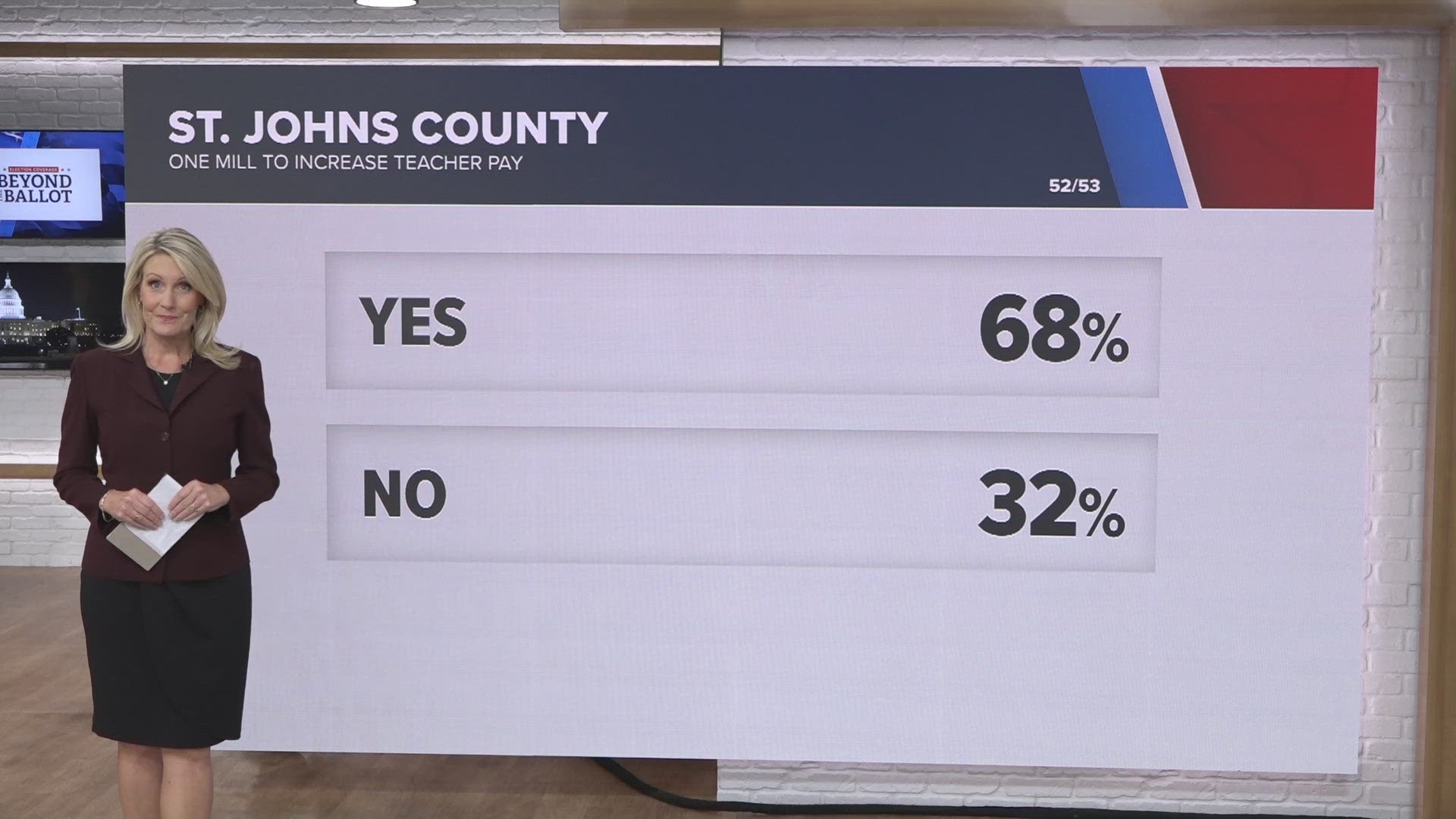

St. Johns County approves property tax rate hike for teacher pay

St. Johns County approved a new 1 mill property tax rate increase the St. Johns County School Board asked voters to approve teacher pay raises. The School Board said it must raise teacher pay so it's competitive with other Northeast Florida counties.

Twenty-five other counties have enacted the same local increase in property taxes for pay raises including Clay, Duval and Nassau counties. The tax will last for five years.

For the owner of a $200,000 home with a $25,000 homestead exemption for school taxes, the 1 million rate would result in an additional $175 on the tax bill. For a $350,000 home with a $25,000 homestead exemption, that tax would add $325 a year.

Clay County backs higher property taxes for land preservation

Clay County voters backed a new dedicated property tax by supporting an additional tax rate of up to 0.2 mills so the county can issue $45 million in bonds for buying and managing land for conservation. The taxes from the higher rate would be dedicated to paying off the debt over a 20-year period.

The referendum says the purchase of the land would "protect water quality in rivers, lakes, creeks, and drinking water sources" while conserving wildlife habitat, natural areas, and working forests and farms. The land also would be part of a strategy to expand outdoor recreation options and reduce flooding.

For the owner of a $200,000 home with a $50,000 homestead exemption for county taxes, the 0.2 mill rate would result in an additional $30 a year on the tax bill. For a $350,000 home with a $50,000 homestead exemption, that tax would add $60 a year.

St. Johns County continues sales tax for school construction

The St. Johns School Board billed its two-pronged referendum this year as "Two Votes, One Decision for Our Students" because the board also sought voter approval for extending the existing half-cent sales tax for school construction and technology upgrades. The School Board said keeping the half-cent sales tax is needed to keep up with increasing population in the fast-growing county.

Clay and Duval are among the 24 counties besides St. Johns County that have a half-cent sales tax for school construction.

This story was first published by our news partner The Florida Times-Union.