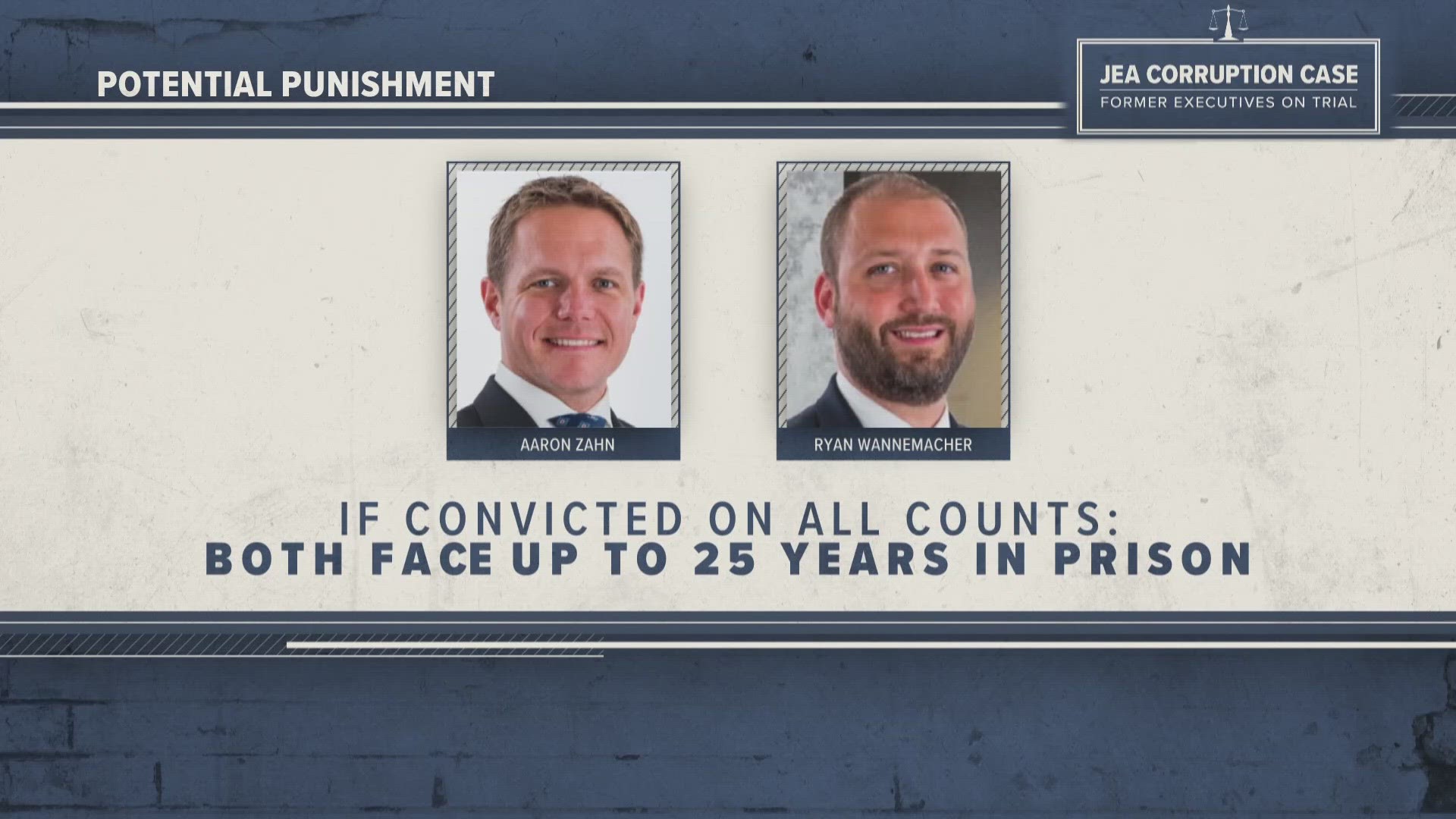

JACKSONVILLE, Fla. — The trial for ex-JEA CEO Aaron Zahn and ex-CFO Ryan Wannemacher continued Wednesday.

Zahn and Wannemacher are accused of crafting a bonus plan, called a performance unit plan, which would make them hundreds of millions if they succeeded in an effort to sell the utility, which could add billions to the bonus pool.

Aaron Zahn’s college roommate was the first to tell the jury Zahn talked about the possibility of profiting from a sale of JEA.

Steven Amdur, an attorney with New York law firm Pillsbury Winthrop Shaw Pittman, was the lead merger and acquisition lawyer on the negotiating efforts to sell JEA.

He also went to Yale with Zahn and lived with him in their senior year.

Wednesday afternoon, Amdur told the jury that Zahn said in May 2019 that then-Mayor Lenny Curry told him he could potentially collect up to $40 million from a successful sale of JEA. According to Amdur, Zahn said other executives could get $10 million apiece. This was months before the board voted to explore selling JEA in July.

In a comment to First Coast News after Amdur recalled this conversation at a pretrial hearing Jan. 31, Curry said only: “That did not happen.”

Amdur said he didn’t know how Zahn could get that $40 million, and did not try to find out.

When Zahn’s attorney, Eddie Suarez, asked if Zahn told him to keep quiet, Amdur said no.

“(Zahn) didn’t take you into a smoke-filled room and say, ‘Steve, this is a secret, don’t tell anyone’?”

“It’s five years ago, and we had a lot of different things going on,” Amdur qualified. “I don’t recall specific words about keeping it quiet as that part of the conversation.”

If he couldn’t remember the words used, Suarez asked, could he remember if he felt uneasy? “I didn’t think it was something I should shout from the rooftops,” Amdur said.

Suarez asked Amdur if this comment could have been about “what (Zahn) understood the mayor would support,” meaning “the mayor was okay with ‘up to’ $40 million.”

When asked if this conversation indicated the money would come from the performance unit plan, Amdur said that he wasn’t aware of that plan’s existence at the time.

Amdur said that he was not aware of anything illegal about the plan, but is not a Florida lawyer, "or a Florida ethics expert."

Rather than argue that Zahn wouldn’t have said that or didn’t stand to gain any money, Suarez stuck to his argument that whatever Zahn said, it wasn’t a secret, and whatever money he admitted he may have earned wasn’t a reference to the performance unit plan.

Amdur agreed with Zahn’s attorney that there were “dozens” of ways an executive could make money off a potential sale.

One option posed by Suarez was a signing bonus should Zahn be kept on by the company who bought JEA.

Federal prosecutor Tysen Duva honed in on this option, asking Amdur: Does that mayor have any power over that? If NextEra, the highest bidder on JEA when the sale was canceled, took over, would they “care what the mayor thought”? After a minute of back-and-forth, in which Zahn’s defense asked Duva to rephrase the question repeatedly, Amdur answered: No, Curry didn’t have the power to win Zahn a bonus in that scenario.

“Not really a difficult question, is it?” Duva asked.

Amdur answered, “No.”

'Perversion of the rules'

Jason Gabriel, who was general counsel for the city of Jacksonville during the botched sale effort, finished his testimony Wednesday.

Suarez cross-examined him for over an hour, but couldn't get him to move from his testimony Tuesday afternoon, where he said he felt "deceived" and thought the plan was "a fantasy," as well as illegal.

During his testimony Wednesday morning, Gabriel called the plan a "perversion of the rules."

Jim Felman, Wannemacher's attorney, made the decision not to cross examine Gabriel.

Gabriel said Tuesday that any situation where a city official was going to make a large profit off of a sale of a public asset would not even need legal review -- it would so obviously be wrong.

When asked the same question Wednesday, Kevin Hyde, an attorney who worked on the sale effort, agreed.

Hyde also testified that the amount of money that would land in the JEA bonus pool if the utility was sold was never disclosed to him. He testified that executives, like Zahn and Wannemacher, have a duty to be honest with the board of directors -- all but one of whom have testified they also did not know how much money was at stake.

Analyst says Zahn was trying to 'force the board's hand'

Tim Hunt, an analyst with JEA who clashed with Zahn over data he presented to the JEA board, testified last Wednesday afternoon.

Hunt was one of a handful of witnesses who testified they did not believe the negative outlook on JEA's financial future, presented by Zahn, was accurate.

Hunt testified roughly the same narrative the prosecution has argued: That Zahn was purposely touting a doom-and-gloom forecast in order to push a sale.

"I did not see any rationale for what was being presented as fact," he said, and his team had not seen data that validated Zahn's outlook.

When he voiced his concerns, Zahn called a meeting with him. He says Zahn told him: "Sometimes you have to use extreme conditions in order to get leverage for appropriate decisions to be made."

When asked how he interpreted this, Duva said he interpreted it to mean Zahn was trying to "force the board’s hand’ to approve a sale."

Testimony will continue Thursday morning.