ST. JOHNS COUNTY, Fla. — You pay taxes, but how is the government spending that money?

St. Johns County's Clerk of Court just published a financial report for fiscal year 2023, showing where your money is going.

It notes the county's population was 315,317.

First Coast News has determined the county grew about 4% from 2022 – 2023.

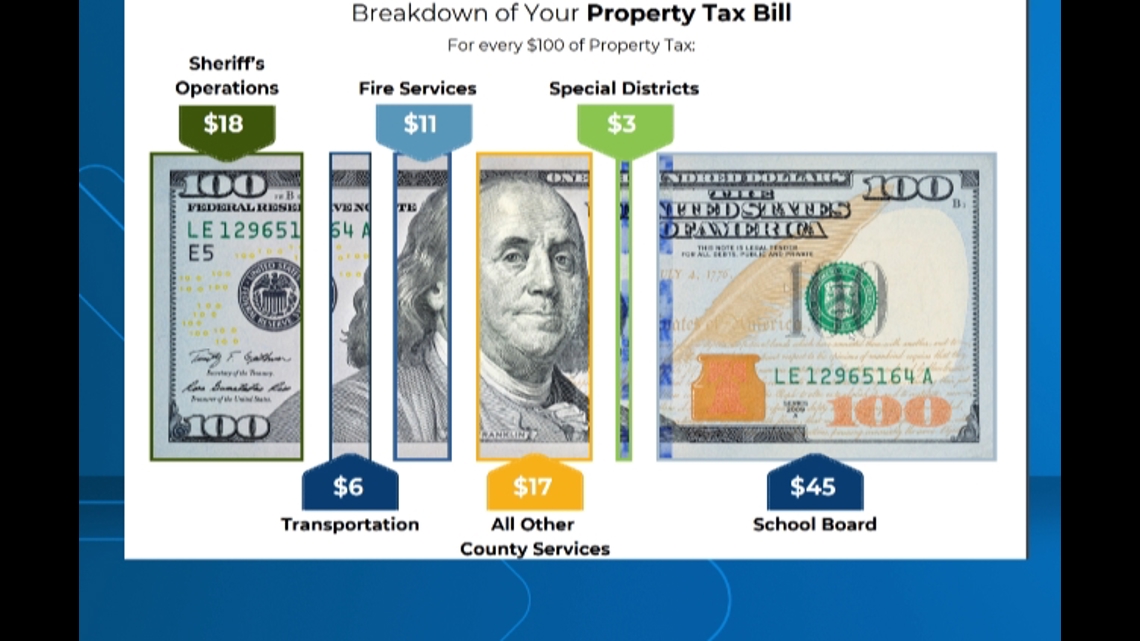

The biggest chunk of money, 39%, that the county has comes from property taxes.

For every $100 paid in property taxes in 2023, the report states $18 went to the sheriff’s operations, $6 went to transportation for the county, $11 went to fire services, $17 went to other county services, $3 to special districts. The largest portion went to the school board, and that's $45 dollars.

The county reports that revenue from property taxes increased by 17.9 percent from the previous year because of "higher overall taxable values and the effects of new construction."

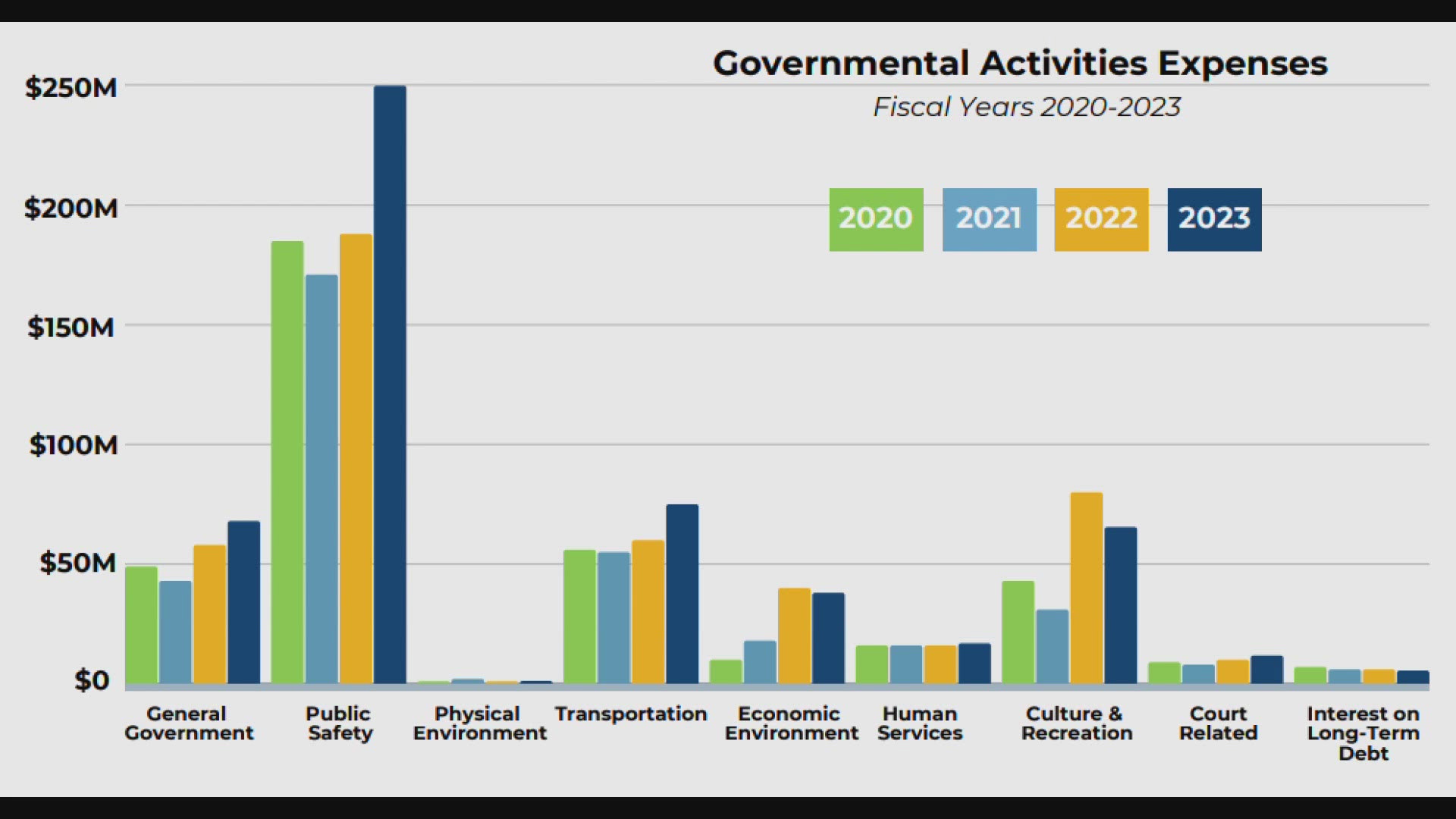

And while St. Johns County collected more money, its expenses were higher too. St. Johns County’s governmental activities expenses rose by $74.1 Million, a 16.2 percent increase over the last year. Public safety accounted for the biggest cost at 47 percent of expenses, according to the report.

At $250 million, public safety costs jumped dramatically over the last year.

The top five taxpayers in the county: Florida Power and Light, Flagler College, Flagler Hospital, Ponte Vedra Corporation, and Northrup Grumman.

The top private employers are Flagler Hospital, Northrup Grumman, the PGA Tour, Florida School for the Deaf and Blind, Carlisle Interconnect Technologies.

Unemployment was 2.7% a little lower than the state’s numbers and much lower than the national figure.

The median household income was approximately $100,000.