After more than a year of legal maneuvers, the fraud trial of former Jacksonville City Council members Katrina Brown and Reggie Brown will open at 9 a.m. Monday in federal court.

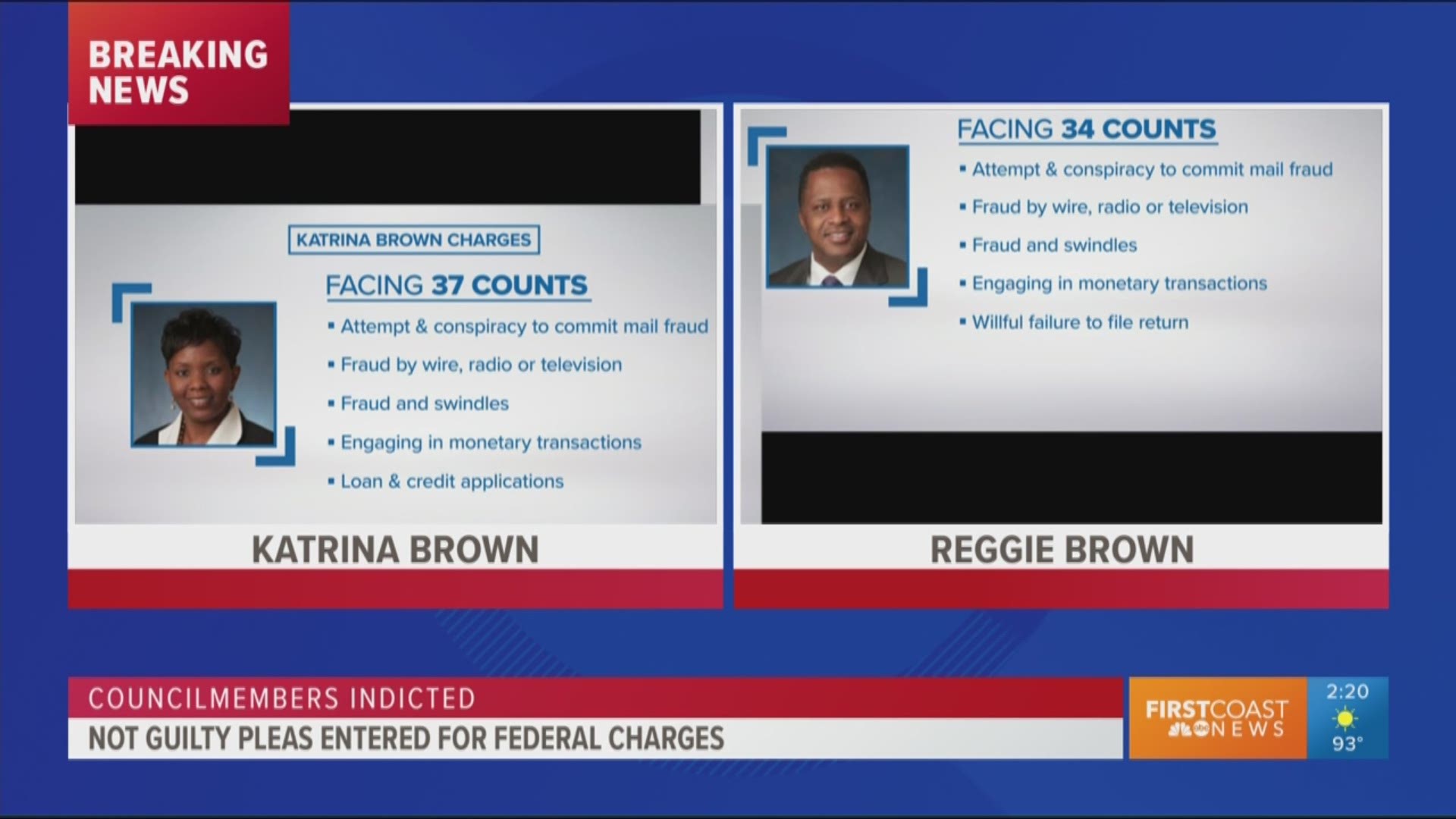

The two politicians, who aren’t related but who both won elections to the City Council in 2015, have pleaded not guilty to dozens of charges.

The case is tied up with the saga of the Jerome Brown BBQ Sauce manufacturing plant that went belly-up after receiving a $2.65 million loan backed by the Small Business Administration, along with a $380,000 city loan and a $210,000 city grant.

This is a primer on the case:

Jerome Brown Barbecue and Wings restaurant opened on Edgewood Avenue in 1997, gaining a following and operating with work by several members of Katrina Brown’s family. After being invited by Wal-Mart executives, Jerome Brown Original Barbecue Sauce went on sale at the Sam’s Club on Dunn Avenue in 2010. It was in 14 stores by the next year, and the family set its sights on opening a manufacturing plant at 5638 Commonwealth Ave. To help the small company grow (and add an expected 56 jobs) jobs, Jacksonville’s City Council cleared the way in May 2011 for a $380,000 city loan that was finalized in 2012 and a 210,000 grant in 2014. In November 2011, Katrina Brown and her mother, Joann Brown, signed a $2.65 million mortgage for Cowealth LLC to buy and refurbish the Commonwealth Avenue building through a U.S. Small Business Administration program.

Q: Who owned the manufacturing plant?

A: Cowealth owned the plant, but the business was run through another family company, Basic Products, LLC. Joann Brown was listed as head of both companies when they were created in May 2011, but Katrina Brown filled that role (“managing member”) at both companies about three months later.

Q: What are Katrina Brown and Reggie Brown accused of doing?

A: Prosecutors said they lied to get money that the lender for the 2011 mortgage, New Orleans-based BizCapital BIDCO I, LLC, wouldn’t have provided if it had known how work was really progressing on the plant. BizCapital had agreed to make the big loan in 2011, but it only released money in “draws” as Katrina Brown submitted invoices from contractors working for Basic Products. Prosecutors said Katrina Brown filed fake invoices from two companies, RB Packaging LLC and A Plus Training Consultants LLC, where Reggie Brown was the only listed officer. They said those companies didn’t provide any services or do any real work, but BizCapital believed the invoices and sent checks that Reggie Brown cashed and returned some of the money to Katrina Brown. Court filings said the case centers around 13 invoices, representing about $264,000, that were filed between 2013 and 2015.

Q: What do the defendants say happened?

A: In short, they said they did nothing wrong. Soon after she was indicted, Katrina Brown said through an attorney that money she received went into the manufacturing business and that she and her family lost money when sauce orders fizzled. From that perspective, the issue would be a failed business venture to be handled through civil and administrative means, not in criminal court. In July, a different attorney for Katrina Brown elaborated, telling a judge the lender “was fully aware that there was no income being generated by Basic Products.” An IRS investigator’s own records showed that more than $90,000 that reached Katrina Brown or Basic Products in 2014 was spent on loan payments to BizCapital and the city, attorney Richard Landes wrote in a court filing. “It is clear that the lender, BizCapital, made itself willfully blind to the knowledge that draws of money were being used to make loan payments,” Landes argued. It’s not clear whether jurors will hear the same argument at trial, since Katrina Brown is now representing herself.

Reggie Brown’s attorney said the councilman “was not signatory on any loan document whatsoever, and merely formed two companies, which were brought into existence in order to implement the worthy goal of getting the businesses up and running.”

Q: What punishment do Katrina Brown and Reggie Brown face if convicted?

A:They both would face likely prison sentences, but the length is hard to say. The real problem is the number of charges against them (37 for Katrina Brown, 34 for Reggie Brown) and the fact that mail and wire fraud charges (there are 26 of those against each defendant) can carry sentences up to 20 years apiece. On paper, Katrina Brown’s time could total up to 720 years and Reggie Brown could face 601 years if the sentences were imposed consecutively and if they received the maximum possible sentence for each count. For comparison, former U.S. Rep. Corrine Brown was sentenced in 2017 to five years in prison for convictions on 18 counts, including a stack of wire and mail fraud convictions.

A: The full reasons haven’t been explained, but basically she wanted a different defense than her attorneys wanted to offer. Everyone has a right to represent themselves, but a judge went out of his way to warn her how dangerous that could be. Katrina Brown had pushed back against another lawyer before, filing a complaint with the Florida Bar about an earlier court-appointed attorney, although the Bar found no wrongdoing.

Q: Why are Katrina Brown and Reggie Brown being tried together?

A:U.S. District Judge Marcia Morales Howard was asked a lot if she’d be willing to sever their cases. Reggie Brown asked to have the cases tried separately, and his attorney said prosecutors could show no basis for the charges he faced and keeping their cases together. Trying them together put Reggie Brown at an unfair disadvantage, attorney Thomas Bell argued. Katrina Brown also asked for a separate trial, saying Reggie Brown “had no knowledge” of part of the indictment and that she’d be willing to testify in his defense if the cases were handled separately. The judge denied separate trials for the two, saying that would require heavy commitments of time and money for the court system and for witnesses who’d have to testify twice.

Q: Katrina Brown was a co-owner of the business with her mother. Why hasn’t anyone else been charged?

A:Federal prosecutors typically set a high standard when deciding whether to charge someone with a crime. Katrina Brown’s indictment mentioned her and an unnamed “Person A” signing a loan the same day she and her mother signed the mortgage, but it doesn’t say that person had any role in filing fake invoices, which are the core of the case. Assistant U.S. Attorney A. Tysen Duva has said in court that no witnesses in this case received plea deals or were promised immunity in return for testimony.

Q: The indictment alleges that Katrina Brown created a fraudulent invoice for $6,083 in furniture purchases from “Person C’s business,” which the indictment calls “Entity A.” What is Entity A?

A: Records that BizCapital sent to the city in 2014 seem to contain an answer. A payment for $6,083, using a check number mentioned in the indictment, was made in October 2013 to VC Gantt LLC. That company’s CEO, Vandaren C. Gantt, is included on a list of potential witnesses prosecutors filed this month. An attorney representing Katrina Brown in June 2018 said then that the invoice for Person C’s business was not fake.

Q: Will the city get back the money it loaned the Jerome Brown BBQ manufacturing plant?

A:It’s trying, but getting the money anytime soon could be very hard. BizCapital got the sauce plant in a foreclosure lawsuit in 2017, so the city can’t try that. Katrina Brown and her mother both signed payment guarantees in 2012, but Katrina Brown’s parents filed for bankruptcy in 2017. The city sued Katrina Brown last year, and in March it won a judgment for $432,000, but months earlier she had presented evidence in federal court convincing a judge she was indigent. The $49,000 yearly salary she earned as a councilwoman stopped when Gov. Rick Scott suspended her from office after the indictment, and would have ended anyway when her term ended June 30. The fastest route to recover some of the money might be if Katrina Brown is acquitted and can collect the money she would have received for her final year on the council, which the city might claim with its court judgment from March.

Q: Weren’t there red flags about this business before this became a federal criminal case?

A: Yes, as The Times-Union explored extensively in an October 2017 story. Some of those red flags include the family failing to pay its property tax bill at the time the city was approving the loan. It was actually the 10th time in 12 years the family was late paying property taxes for its business. The family’s financial history also included four bankruptcy filings in the 1990s and a string of state Department of Revenue actions that included late payment of $11,461 in sales taxes in 2009, according to court records.

Q: It feels like we’ve had a lot of high-profile criminal cases involving elected officials. Who else has gotten into trouble in recent years?

A:Former U.S. Rep. Corrine Brown, who was sentenced to five years in prison in 2017, is the biggest name on the list, but there have been others. Notable prison terms included a 40-month sentence in 2012 for former Jacksonville Port Authority Chairman Tony Nelson and a 21-month term in 2010 for former St. Johns County Commission Chairman Tom Manuel.