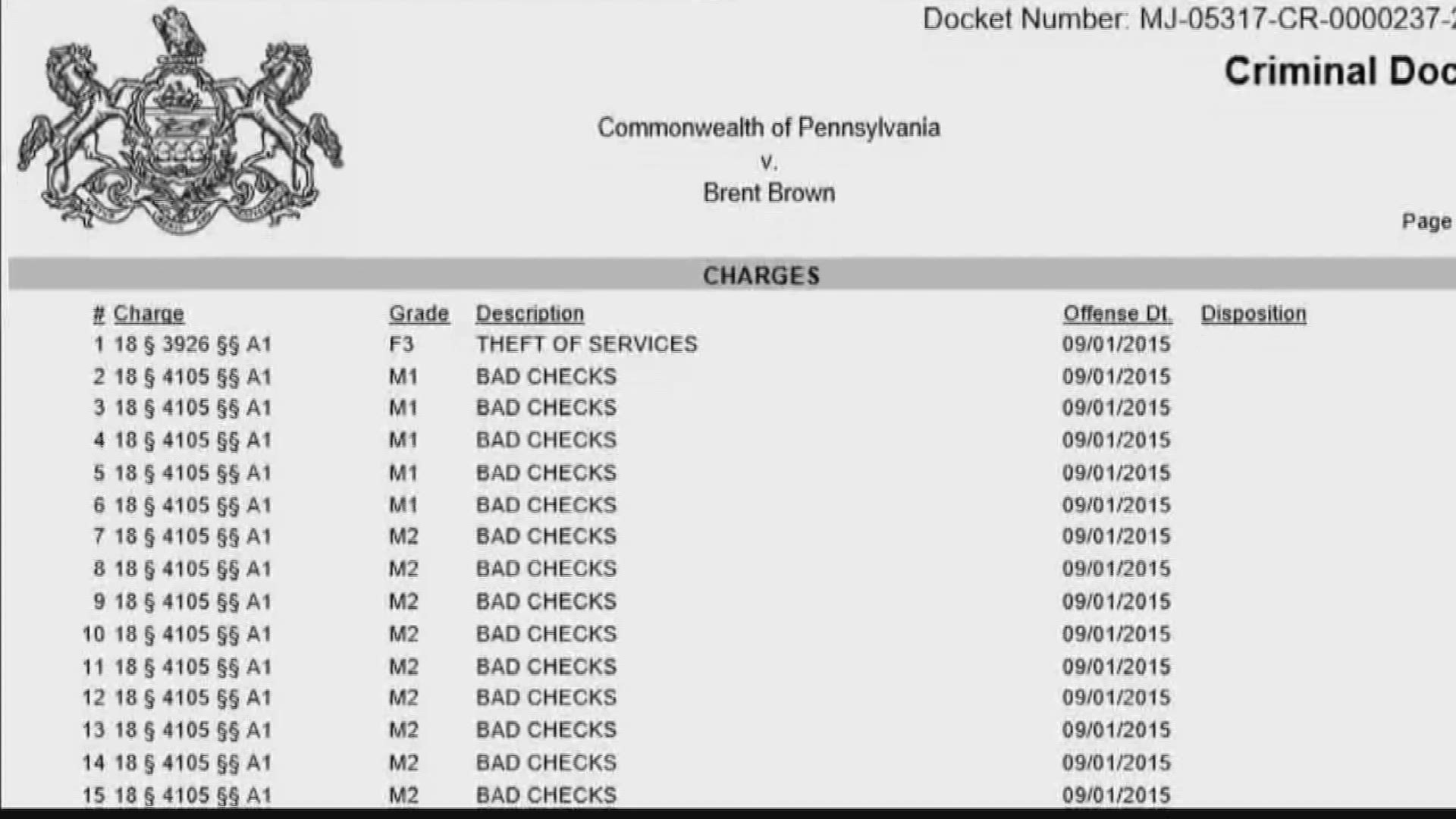

JACKSONVILLE, Fla. — Editor's Note: The video above is from a story on Brent Brown's 2017 indictment on different charges.

The former owner of Latitude 360 has been indicted on federal charges for failure to remit the IRS money withheld from his employees' paychecks for taxes, according to the Department of Justice.

Brent Brown began Latitude 360 in Jacksonville in 2014 with subsidiaries in Indianapolis, Pittsburgh, Albany and Jacksonville. Latitude 360 was an family entertainment center with a game room, bowling, a theater and a restaurant.

According to the DOJ, Brown had exclusive authority over the company's business funds.

All of his subsidiaries withheld taxes from employee wages, including federal income taxes, which the company would be required to remit to the Internal Revenue Service (IRS).

According to prosecutors, while Brown's quarterly tax filings reflected the payroll taxes due for each of the subsidiaries under his control, he did not remit the full amount to the IRS.

The Department of Justice says Brown owes more than $1 million.

Brown faces 17 counts in the indictment. If convicted, he could face five years in prison for each count, a total of 85 years.

In 2016, Latitude 360 shut down in Jacksonville due to being millions of dollars behind in rent. In 2017, Brown was charged with theft of services, among others.