CLAY COUNTY, Fla. — Earlier this year, people started receiving checks in the mail as part of an Apple settlement that alleged software updates were hurting performance in iPhones. Our verify team looked into it and the checks are real.

But, when one Clay County woman tried to cash her check, there was an issue. She contacted the 'Ask Anthony' team for help.

"I was surprised my credit union sent it back to me," Desiree McNeil told Anthony Austin.

You may have heard about Apple's “batterygate” settlement back in 2020. It was the result of a class action lawsuit that alleged Apple issued software updates that slowed down the battery performance of iPhones.

While Apple did not admit liability or wrongdoing as part of the settlement, the company did agree to pay up to $500 million to consumers.

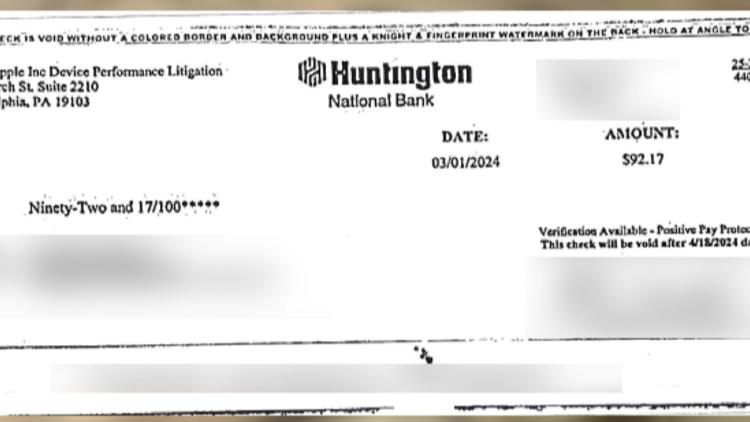

Desiree McNeil of Green Cove Springs was one of the claimants. She received a check for $92.17. Payouts began on January 5th of this year.

She cashed her check on April 1.

"By April 3, my credit union returned a check for insufficient funds. They said that the litigants didn't pay it. I sent them an email. To date, there has been no response," McNeil explained.

McNeil's credit union sent a letter that said the check was "stale dated." Basically, it was too old. But, according to the front of the check, she had until April 18th before it would become void.

McNeil said the perfect resolution would be for her to receive the money she's owed.

"That's all I'm looking for. No more, no less," McNeil said.

The check was issued by Huntington Bank with corporate offices in Columbus, Ohio. Anthony Austin heard back from a representative with Huntington Bank who said they were looking into the issue.

However, the representative said the bank only issued the check. It would be the administrator of the account who would be responsible for the actual payment.

We've contacted the administrator, by phone and email, and will let you know when we receive a response.