JACKSONVILLE, Fla. — Have you almost fainted after opening an envelope or email with the final invoice for a hospital or doctor's visit? You're not alone.

The Ask Anthony team receives emails from viewers every week who find discrepancies on their medical bills or believe the costs are incorrect. For example, Jill sent this email after getting a test at a local hospital:

"The test cost $5,405! What it consists of is me showing up to one of their offices, picking up a heart rate monitor device, bringing it home and reading the directions on how to put it on, then wearing it for 2 weeks, and returning it to the same office. They read the results. That’s it...and it costs $5,405. I can hardly believe that since I never physically saw a doctor related to that test."

According to a recent survey, one in five people said they got a medical bill they disagreed with or couldn't afford over the past year. According to an NBC news article, almost 62% of people who reached out about an unaffordable bill got a payment plan or a price drop.

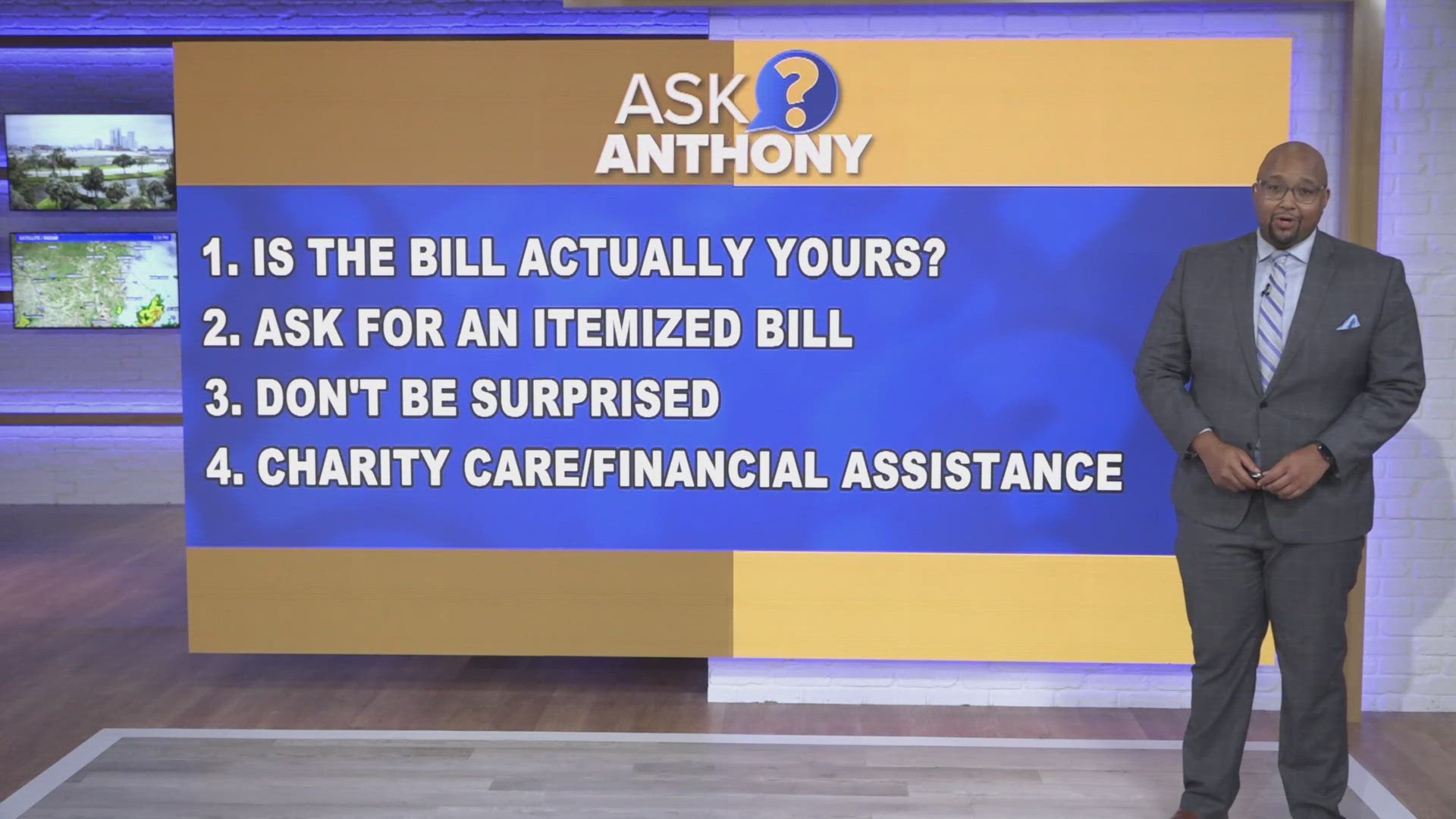

What is the best way to dispute a medical bill? Anthony Austin spoke with Michele Johnson, executive director of the Tennessee Justice Center. They talked about four things you can do to challenge a medical bill.

First of all, make sure it's actually your bill.

"My name is Johnson. So, you need to make sure you're not billed for another Johnson, and that happens in a surprising number of cases," Michele Johnson explained.

Also, ask for an itemized bill with a detailed list of all the services, treatments and procedures you received during the visit. Hospitals are required to send an itemized bill within 30 days of a request.

"Look at that itemized bill to see what they are charging you for. Did you receive those services? In a surprising number of situations, you might not have received those services and you shouldn't be paying for them," Johnson added.

In 2020, a law was passed that protects people with insurance from getting "surprise" medical bills when they get medical services from an out-of-network provider at an in-network facility. For example, maybe your doctor tells you to go to a hospital that's in your network for surgery, but the anesthesiologist is actually out-of-network.

You didn't know that and get a big bill later.

"They have to tell you beforehand what the charge will be. That's a huge protection for people who have in the past been bankrupted by one surgery where they followed all the rules," Johnson explained.

Johnson said a lot of hospitals offer financial assistance, also known as charity care. It is usually posted on their website. For example, UF Health provided $42.9 million in charity care with no reimbursement in 2022.

"The bills for medical care are so expensive that you can be fairly middle class and still not afford them. Make sure if you get a bill that you reach out to the hospital and ask if it's possible you qualify for charity care. It is possible that they might write off the bill," Johnson said.

If you still have to pay the bill, a lot of hospitals will offer payment plans.