LAKE CITY, Fla. — A Lake City man and woman are facing a federal indictment of 13 charges for running a scam targeting minorities, prosecutors said.

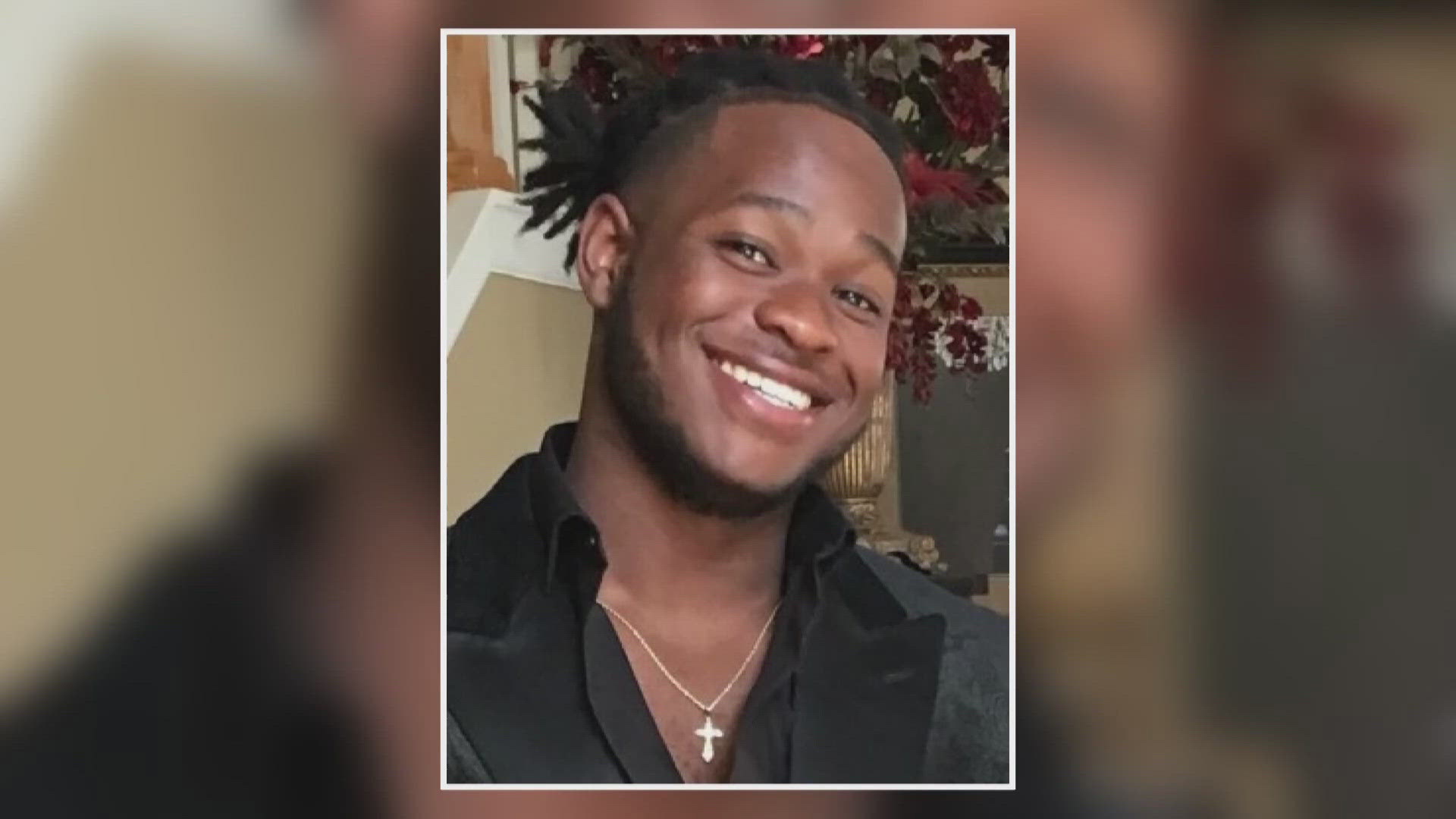

Treashonna Graham, 40, and Joey Williams, 39, face one count of conspiracy to commit wire fraud, seven counts of wire fraud and five counts of money laundering. Prosecutors said they face up to 20 years in prison for each conspiracy and wire fraud offense, and up to 10 years’ imprisonment for each money laundering offense if convicted.

They were arrested on May 31.

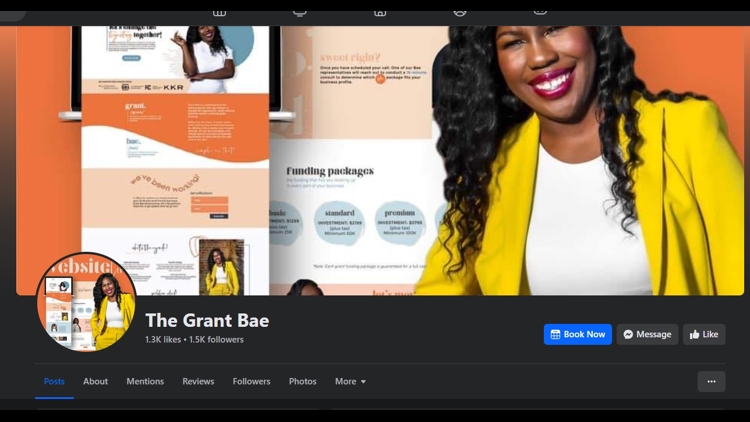

According to the indictment, Graham and Williams ran a company called “Grant Bae,” which was designed to assist minority business owners obtain government grants ranging from $25,000-$250,000.

Graham and Williams would charge a fee for their services and would advise clients that they were in the process of obtaining grant money on their behalf, prosecutors said. Graham and Williams allegedly stole approximately $2,904,667 of their clients’ grant funds and used those funds to live an extravagant lifestyle.

The two bought vehicles, jewelry, clothing, and other personal property, the indictment said, as well as gambling away some of the money.

According to an FTC investigation, the company was temporarily shut down and had its assets frozen in 2022.

The complaint said that Florida-based Grant Bae violated the COVID-19 Consumer Protection Act, the FTC Act, and the Florida Deceptive Unfair Trade Practices Act by targeting minority-owned businesses, by claiming "that they could access millions of dollars in grant funding if they paid for the company’s services."

“These scammers targeted minority-owned businesses and misused public funds meant to support honest businesses during the pandemic,” Director of the FTC’s Bureau of Consumer Protection Samuel Levine said in 2022. “Working with our state partners and with new authority granted by Congress, we will continue to shut down frauds that prey on people during the pandemic.”

The complaint alleged Grant Bae was responsible for falsely promising significant returns, misleading customers about grant status, deceiving customers about access to grants, lying about prior success and failing to provide promised refunds. In one online video, the complaint continued, Graham said she would block "anyone and everyone who feels that they are investing their money in a scam."