JACKSONVILLE, Fla. — When Mincy Pollock made a pitch to other African-American business owners about joining him as a JAX Chamber member, the response typically was a dismissive "why bother" shrug.

As much as Pollock sees the chamber as a valuable way for growing his two small businesses — Florida Care Insurance and Pollock Group — he could understand the skepticism.

"When I go to the (chamber) meetings, a lot of times, as my grandma would say, I'm a fly in a glass of milk," he said. "I would go and I would talk to other business owners about 'Hey, you really should be connected with the chamber,' and they have said in the past, 'It doesn't look like we fit. I don't know if they want us.'"

As the year brings new attention to racial justice and inequity across the country, big corporations are taking notice of such divisions in the business world and the community.

The past few months have seen an increase in companies teaming up with local schools, businesses and organizations to form initiatives that help communities of color.

In Jacksonville, recent examples include the local cigar company Swisher sponsoring a program with the University of North Florida for entrepreneurs from underrepresented communities, Southeastern Grocers launching a diversity grant program to address racial disparities when it comes to access to food and medical care and PepsiCo. funding a grant program with the National Urban League to aid Black-owned restaurants.

Now, a partnership between Florida State College at Jacksonville (FSCJ) and Bank of America centers around a $1 million jobs initiative partnership to help students of color complete training and education necessary to enter the workforce. The program is set to work with the JAX Chamber to ensure specific hiring needs are addressed.

JAX Chamber announced it will launch its own initiative called the Lewis and White Business League that will create forums for networking and mentoring along with quarterly meetings with guest speakers.

The business league takes its name in honor of A.L. Lewis and Dr. Eartha White, two influential Jacksonville leaders who were charter members of the National Negro Business League founded in 1900 by Booker T. Washington.

The flowering of the new programs comes after Black Lives Matter marches and rallies in Jacksonville and across the nation protested racial disparities. While those demonstrations focused primarily on the criminal justice system after the death of George Floyd at the hands of Minneapolis police, the message applies to race-based economic gaps as well.

Some people can be leery about the new outreach. How do you know if a gesture is just lip service and won't address larger, systemic issues Jacksonville grapples with when it comes to race and equity?

"The proof will be in the pudding when valuing the utility of these post-George Floyd programs," local activist Earl Johnson Jr. — the son of the well-known civil rights attorney — said.

It's not the first time such programs have been rolled out, and the results across the country have been mixed.

"Large corporate sponsorships of Black business incubator initiatives are certainly not new," Johnson said. "Local McDonald’s mogul Willard Payne was a Chicago high school coach in the 1970s when he entered into the McDonald’s franchise program focused on minority ownership. But the success stories related to these initiatives have frankly been far and few between."

Greg Smith, the Jacksonville market president for Bank of America, said "jobs are a critical pillar to address the racial wealth gap in Jacksonville" and the FSCJ partnership is part of a larger plan to advance economic mobility through hyper-targeted focuses on education and workforce training.

"Statistically, underrepresented populations such as the ones designated in this grant are not represented or persistent in college or career certification programs," said Lisa Moore, FSCJ's Chief Diversity, Equity and Inclusion Officer/Executive Director. "As a result, they are not able to qualify for high need/high wage jobs. This opportunity will allow FSCJ to affect the academic and career outcomes while providing the necessary services to give true access and opportunity.",

Smith pointed to the $190,000 that Bank of America distributed to nonprofits helping Jacksonville residents gain employment this year. He said the grants were part of a $1 billion, four-year commitment to advance racial equality and economic opportunity.

"We are invested in the success of this city and are thoughtful about who we partner with, which is why FSCJ is the right fit for this initiative," Smith said. "They have an integral understanding of the needs and opportunities for students of color and are on the front line in bringing change through their educational programs."

While the FSCJ program is aimed at preparing college students for future success, the chamber of commerce's Lewis and White Business League will seek to connect businesses owned by African-Americans with companies across the city, expanding the playing field for them.

Pollock said Black-owned businesses tend to operate "in silos" that limit their opportunities for new accounts and customers.

"I think Black businesses lack the connectivity," he said. "Yes, they can network, but how do big corporations allow small businesses to do business with them. They want to but don't know how to. I think that's the magic formula."

The chamber began looking at ways to respond when protests emerged nationwide.

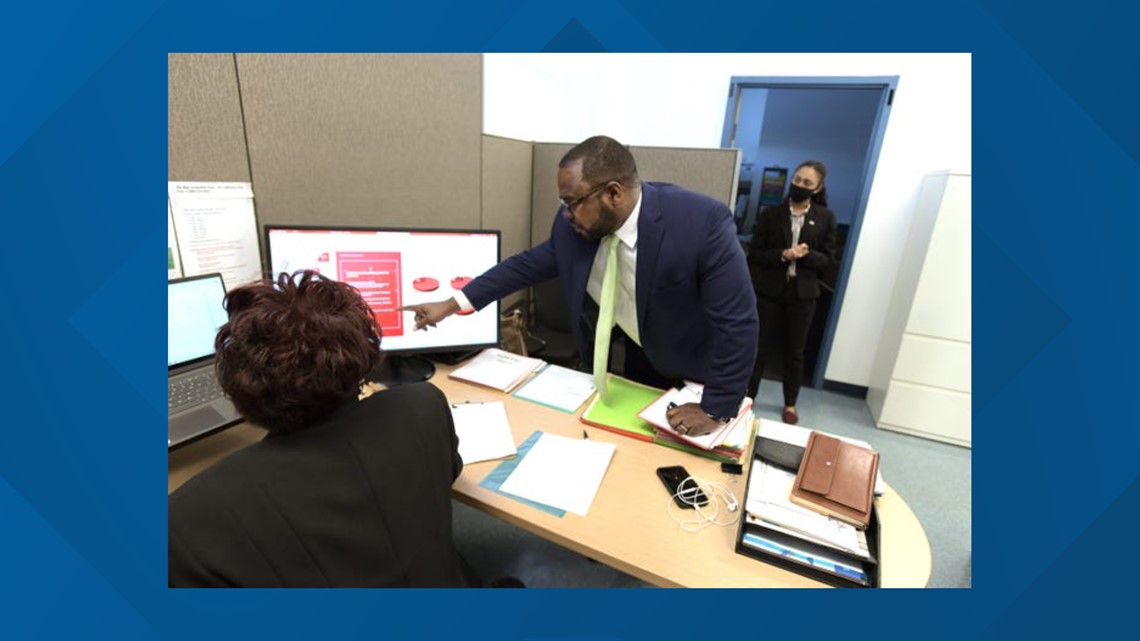

"We had lots of corporations asking us what they could do in a structured way to help shape economic opportunities for African-Americans and African-American business owners," said Carlton Robinson, chief innovation officer for the chamber.

Jacksonville-based Miller Electric, for instance, announced a $1 million donation to United Way of Northeast Florida to help advance racial equity and social justice in Northeast Florida. Company CEO Henry Brown said Miller Electric did not want to "sit on the sidelines."

Chamber leaders met with African-American business owners and heard they wanted a way to hook up with bigger companies they didn't feel the chamber offered as much access as it did years ago when it had a northwest Jacksonville council, which is the part of the city with the largest proportion of Black residents.

"We're basically a medium and a curator, we hope, for opportunity," he said.

Nationally, African-Americans accounted for $1.3 trillion in buying power in 2018, which was nearly 9 percent of the total buying power for the entire country, according to a Multicultural Economy Report by the University of Georgia.

The latest U.S. Census Bureau data for business-ownership showed that in 2017, African-Americans owned about 124,000 firms nationally, or about 2 percent of all firms.

Pollock, a Jacksonville native who graduated from Ribault High School and earned a college degree at Edward Waters College, said he had confidence when he started his businesses that he could tap into an underserved market. His insurance company began by focusing on Affordable Care Act policies. The Pollock Group helps puts on the annual Florida Black Expo.

He said the JAX Chamber connection has helped him branch out. His first group insurance policy, for instance, was a result of meeting a business owner through the chamber.

Johnson pointed to one particular hometown hero for an example of local success.

"Jacksonville has a very large black middle class, which suggests that Black businesses here, in general, have a real opportunity to succeed," he said. "Black celebrity chef Kenny Gilbert — Oprah‘s favorite barbecuer — is a prime example of what is possible here in the restaurant industry. But he may well be an outlier."

Gilbert, who gained notoriety for his appearances on Food Network's Top Chef, has owned a number of businesses in Jacksonville. His latest, Silkie's, is a chicken, biscuits and champagne bar in the heart of the Springfield neighborhood.

When asked about the string of new corporate initiatives, Gilbert voiced similar reservations as Johnson.

"I think it’s great that corporations are looking at their budgets and determining how much they can afford to help this initiative to ultimately help them. They realize this is not going away and it would benefit them to train up which is the future of the country," the chef said. "I don’t know if I trust anybody. If they are sincere it will be evident and definitely talked about."

Gilbert says too much red tape and process to apply for help could scare potential business owners away.

To add to it all, residents say it's hard to look past acts of racism encountered in Duval County. Just this week, Times-Union news partners First Coast News reported on murals in Lakeshore representing Black people being defaced with paint stripper for the second time. The vandalism is being investigated as a hate crime.

Johnson said reservations continue through the COVID-19 pandemic and in turn, the hit Black businesses have taken from the economy's downtick.

"That truth was again reflected this year when the vast majority of viable black businesses had no chance to receive COVID-related forgivable loans," he said. "As a result, half of all Black businesses in America are gone."

Reports show Black businesses have been hit extra hard by the pandemic.

"Many people in Northeast Florida are grappling with the ongoing implications of the coronavirus pandemic and are finding themselves suddenly jobless," Moore with FSCJ said. "This initiative will be a source of hope for our community and a catalyst for achieving meaningful change in advancing academic access and economic opportunity."

A Stanford University study estimated that more than 40 percent of Black-owned businesses shut down across the country. A report from the Federal Reserve Bank of New York noted that a mix of geography, the limited reach of key federal aid programs and weaker ties to banks prompted the harsh impacts.

"Both Bank of America and FSCJ know that individuals and communities of color have been disproportionately impacted by the current health crisis," Smith, from Bank of America, said. "Education and training are fundamental to improving the racial wealth gap in Jacksonville."

When asked how Bank of America and FSCJ will measure the program's success, Smith said it will be based on a combination of factors including graduation rates, coursework and the number of high-wage jobs secured in the city by program completers.

"Specific goal setting will be an integral part of this program – with an end result of a stronger hiring pipeline for people of color," Smith said.

"We know that currently only 28.8 percent of Black students and 37.1 percent of Hispanic students earn a certificate or degree within six years of enrollment at community colleges. So, success for this program will not only be based on seeing an increase in those graduation rates, but also seeing a shift in the college coursework so that it matches the opportunities for students to enter high-need, high-wage jobs that will put them on a path for success in Jacksonville."

The Bank of America program is open to current and prospective students at FSCJ. More information is available via the school's website. JAX Chamber will start activities through its Lewis and White Business League in early 2021.

"I think they've listened and now they're responded," Pollock said. "Everyone in the room when they made the announcement said, 'We look forward to the next steps.' The question wasn't, 'Well, we'll see if the next steps happen.'"

Still, Johnson said residents will have to wait and see.

"Only time will tell whether it’s simply the soup du jour," he said. "What is painfully clear though is that Black entrepreneurs have an easier time getting a loan for an $80,000 Cadillac than they do for a $50,000 small business loan."