JACKSONVILLE, Fla — You can start filing your taxes as of Jan. 24. The IRS is giving criminals a heads up. Posts have been circulating online for the last month about tax laws targeting criminals.

THE QUESTION

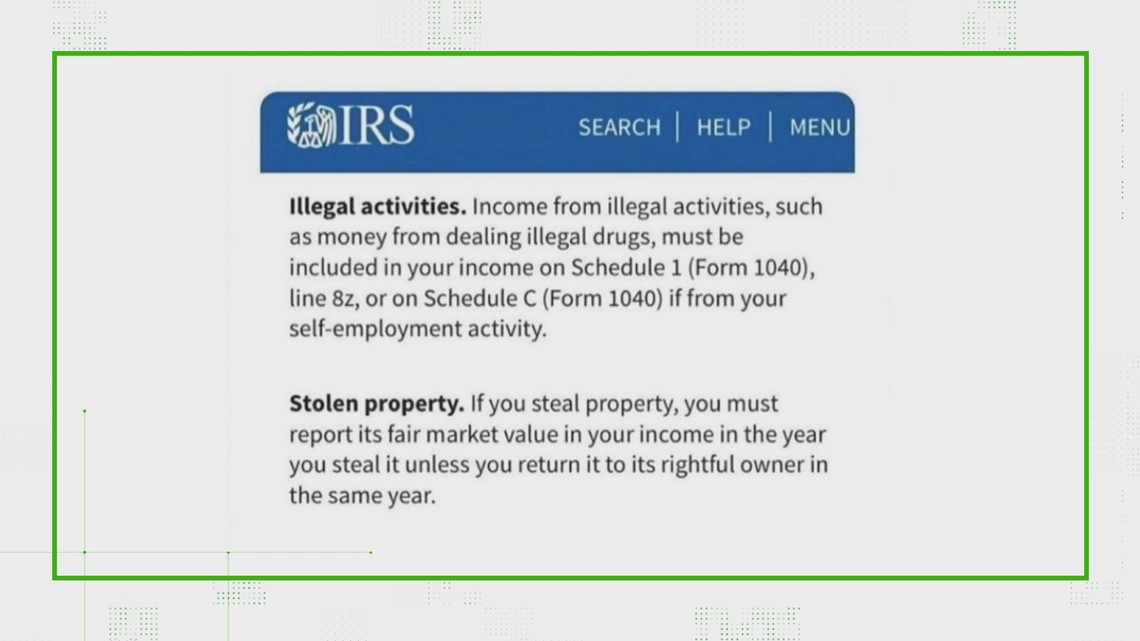

Do criminals really have to report their illegal income and stolen property?

THE SOURCES

- Internal Revenue Service

- Keith Jones, CPA with CPA Tax Problem Solver

THE ANSWER

Yes. This is verified!

WHAT WE FOUND

The IRS says income from illegal activities, such as money from dealing illegal drugs, must be included in your income from your self-employment activity. If you steal property, you must report it in your income, unless in the same year, you return it to its rightful owner.

Story continues below.

“I can’t really explain to you why they decided to post it, but most people think it’s kind of humorous to be honest with you," Jones said. "Because what criminal in his right mind is going to put income on stuff he stole?”

Ironically, Jones says an honest criminal on their taxes may be able to get a bigger refund if they actually follow these rules.

“You can take someone who is living a nefarious life. All he does is steal for a living," Jones said. "If he did report what he stole, then you have income that would qualify for a credit. He would actually probably get more back than what he owed."

According to an NBC News report, tax returns are confidential. The IRS can’t share the information unless law enforcement has a case and gets a court order, so it is less risky than it sounds.

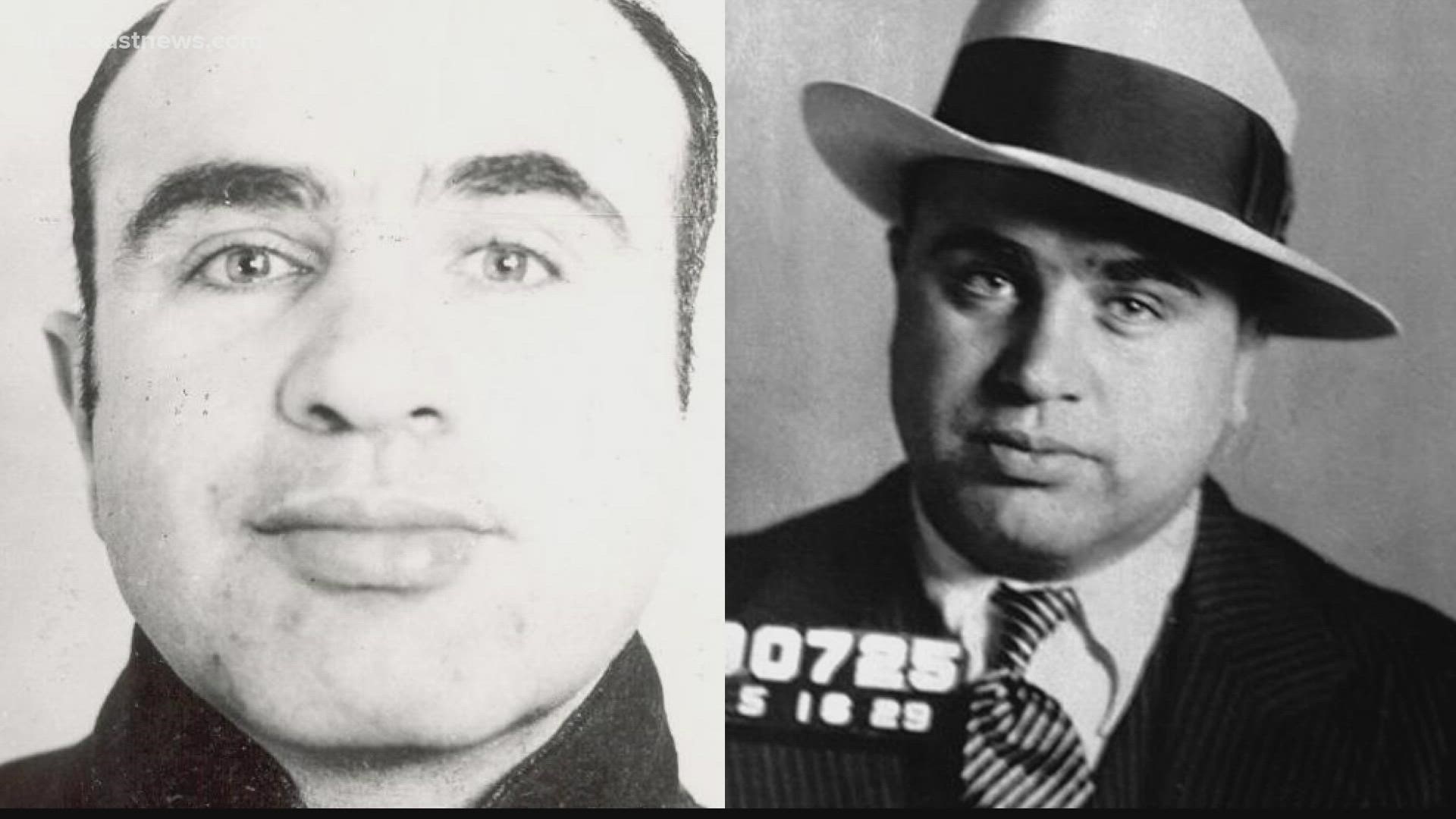

Also by not reporting your illegal income, that’s tax evasion. Jones says this is how Al Capone was caught -- which means this has been on the laws for years.